likelihood of capital gains tax increase in 2021

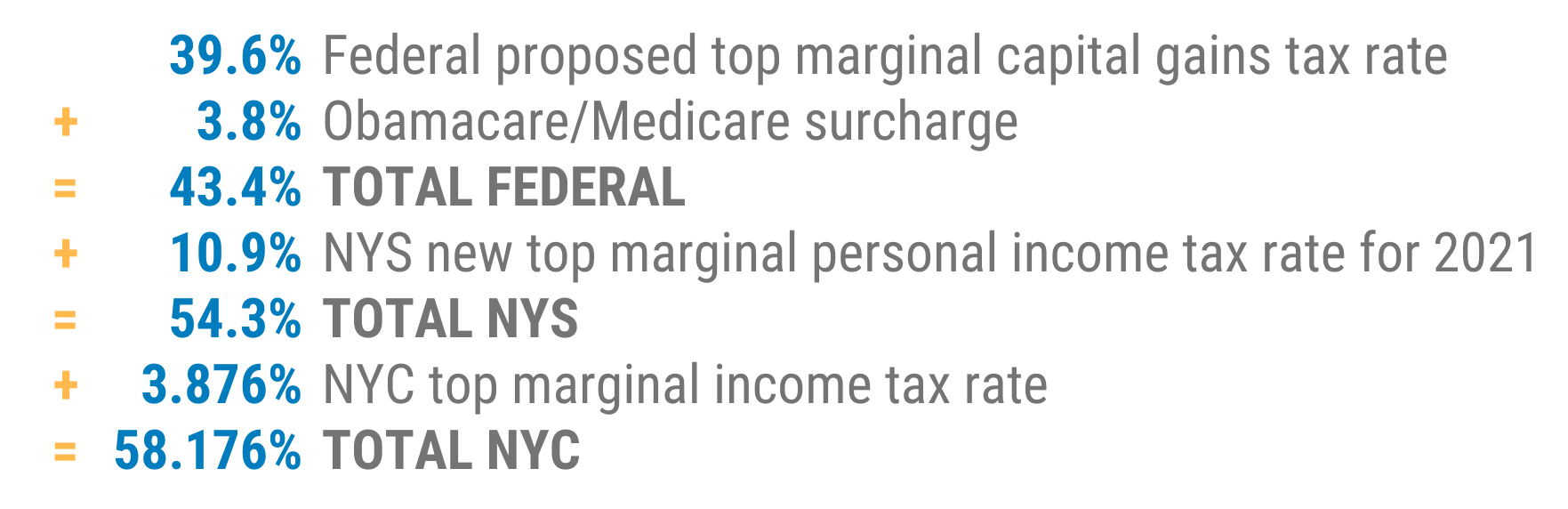

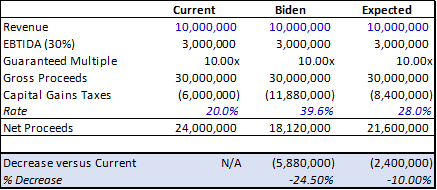

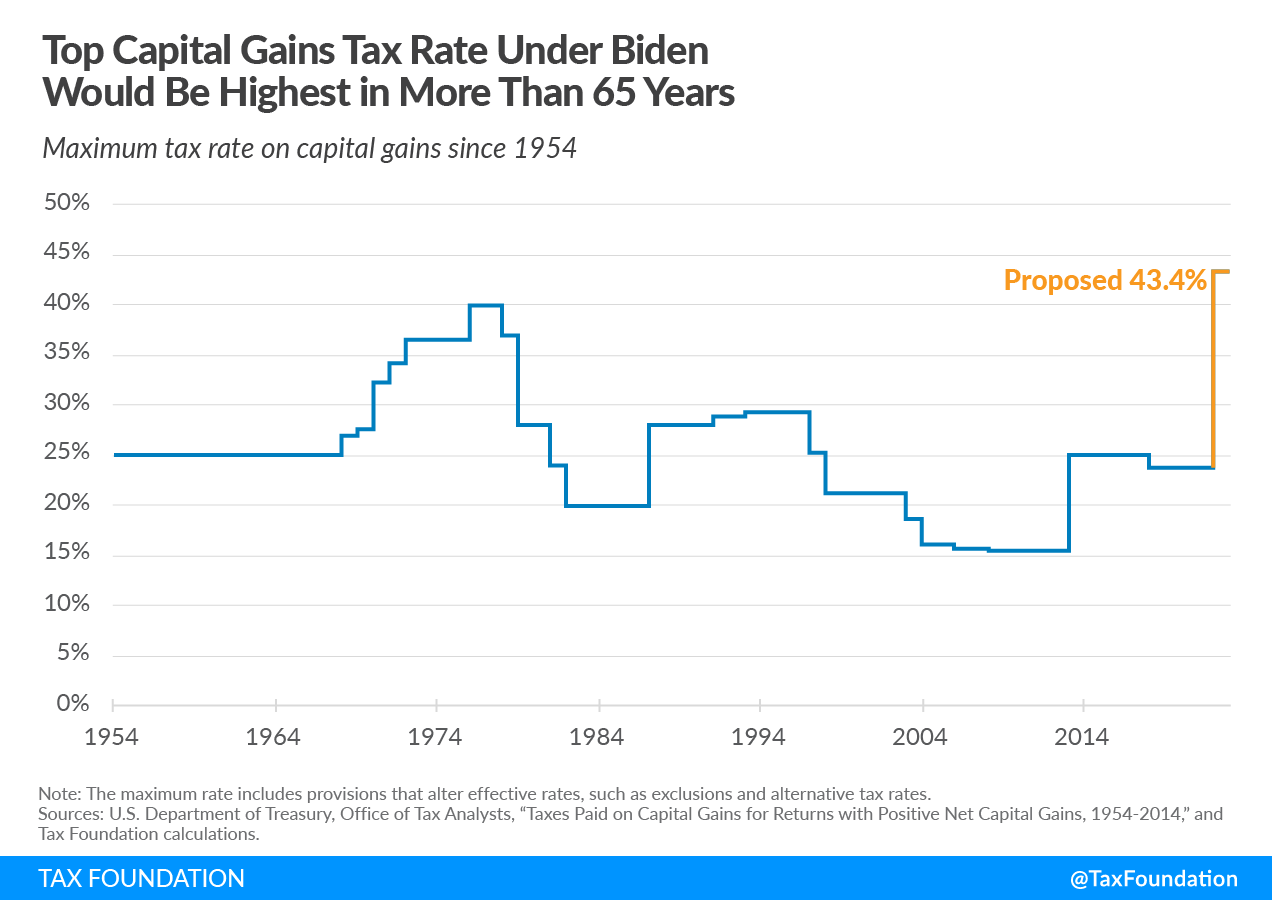

Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. The current capital gain tax rate for wealthy investors is 20.

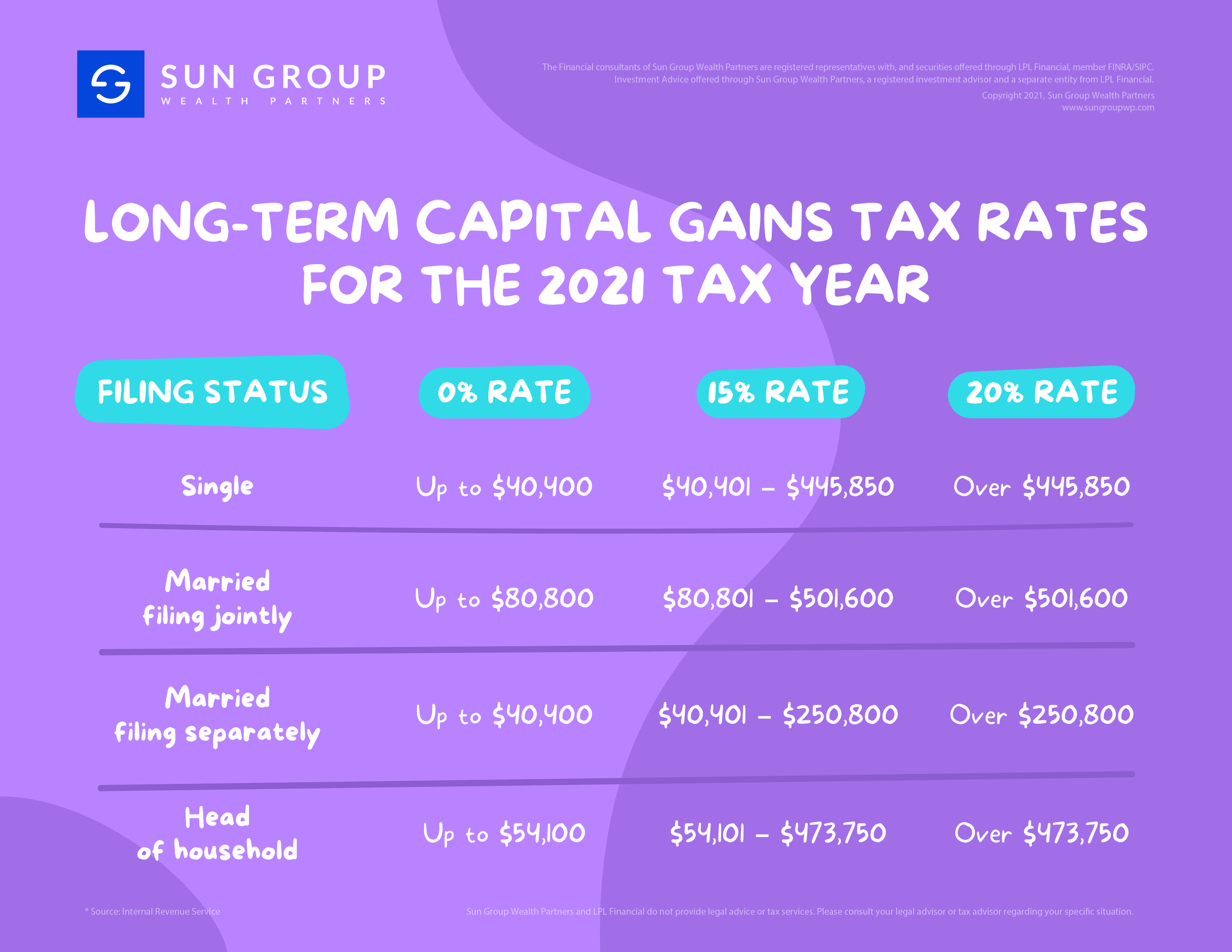

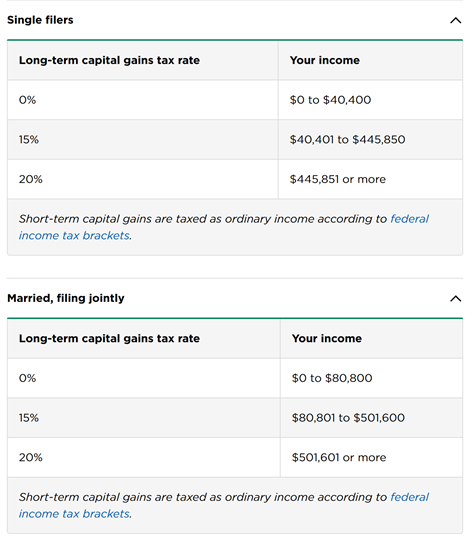

Long Term Capital Gains Tax Rates For The 2021 Tax Year Sun Group Wealth Partners

Note that short-term capital gains taxes are even higher.

. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. While it is unknown what the final legislation may contain the elimination of a rate. That would be the highest tax rate on investment gains which are mostly paid.

There will be a budget in the spring of 2021. Likelihood of capital gains tax increase in 2021 Tuesday June 14 2022 Edit. The proposal would increase the maximum stated capital gain rate from 20 to 25.

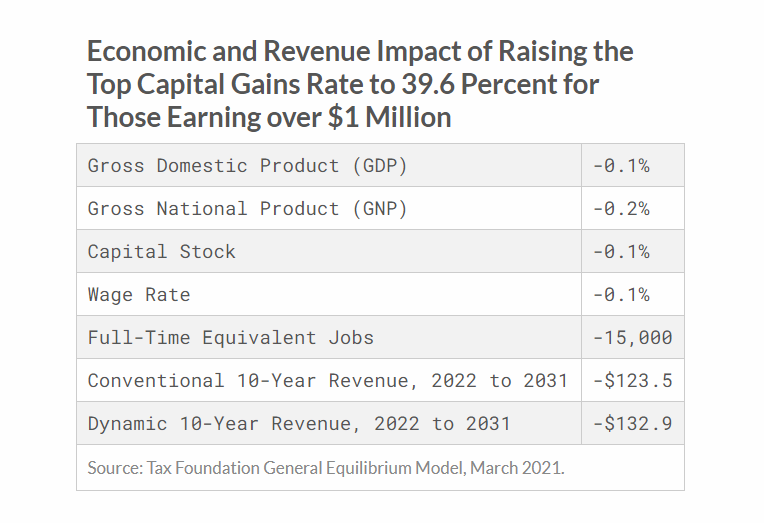

A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. It would also nearly double taxes on capital gains to 396 for people earning more than 1 million.

The effective date for this increase would be September 13 2021. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. Capital gains taxes simply are taxes levied on profits from selling an investment.

Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said. In terms of timing there is a clear consensus that now is not the time to increase tax rates. Short-term gains are taxed as ordinary income.

Capital Gains Tax 101 Selling Stock How Capital Gains Are Taxed The Motley Fool. So if you buy 10000 in stock and sell those shares five years later for 20000 you will likely. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

The Chancellor will announce the next Budget on 3 March 2021. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Many speculate that he will increase the rates of capital.

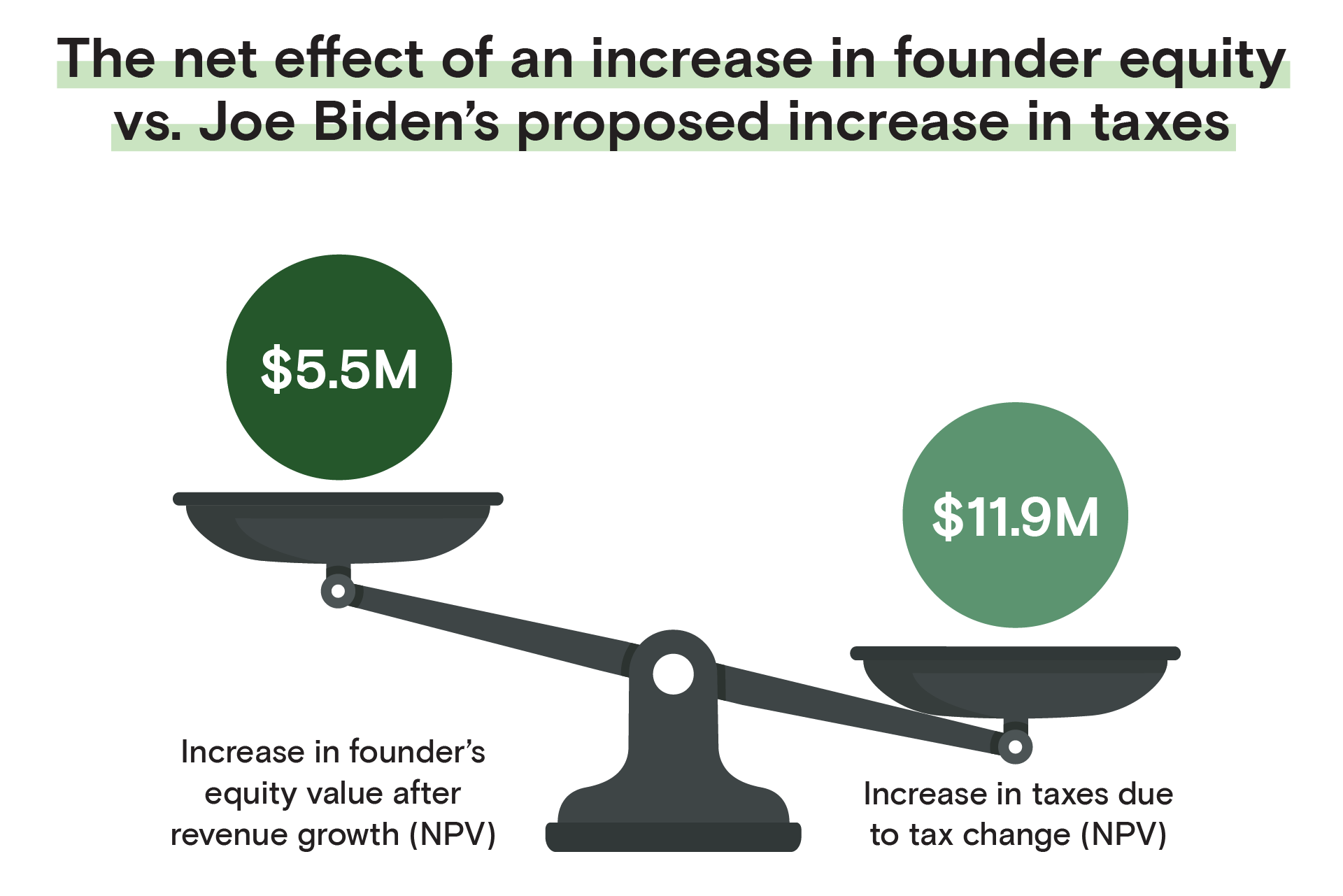

Implications for business owners. It is possible the rates may increase from 6 April 2021. Apr 23 2021 305 AM.

However it was struck down in March 2022. Assume the Federal capital gains tax rate in 2026 becomes 28. Capital gains tax is likely to rise to near 28 rather.

What You Need To Know About Capital Gains Tax

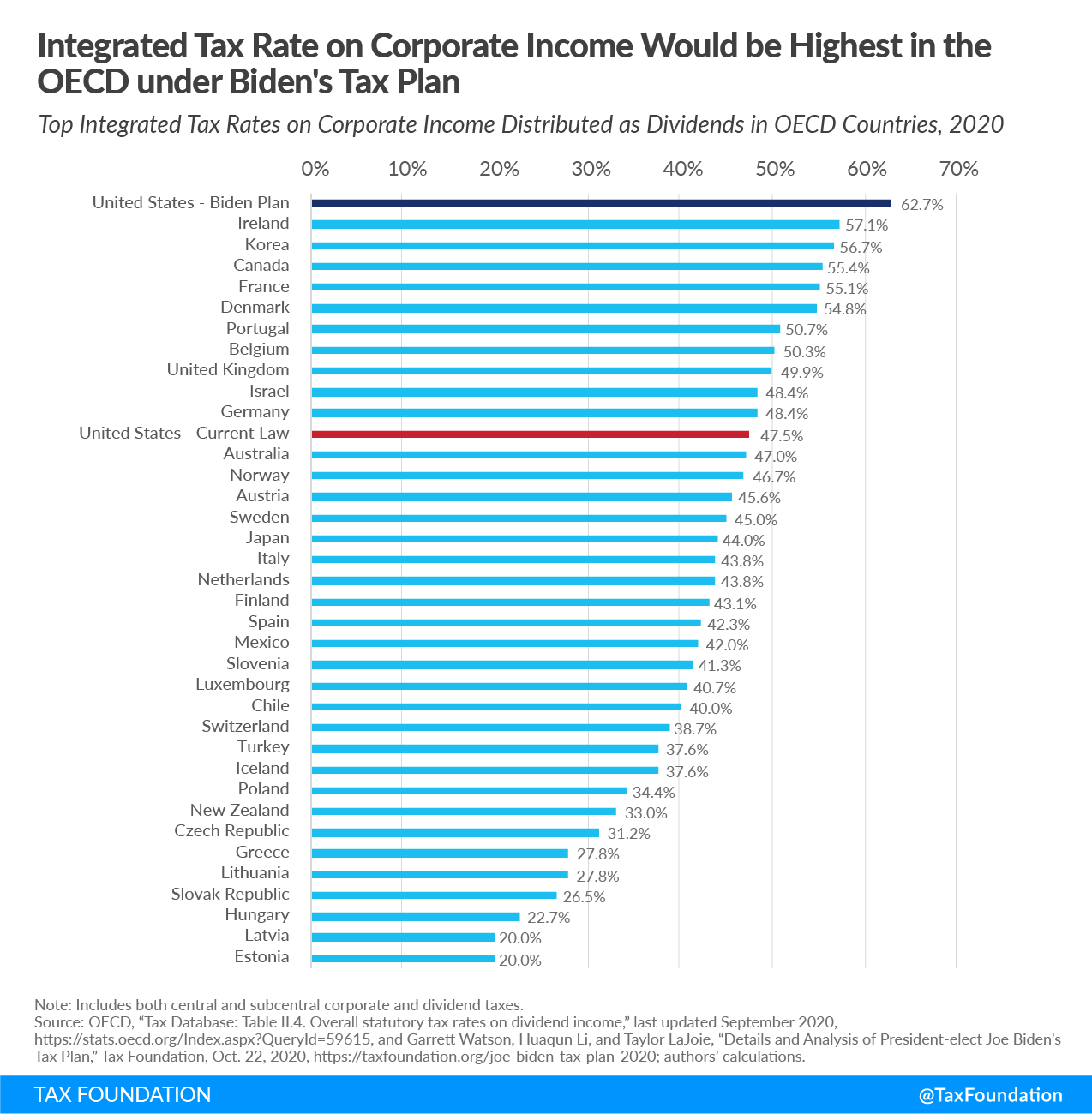

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Markets Eerily Silent Amid Surprise Report On Capital Gains Tax Hikes

Do The Math Cap Gains Tax Hike For New Yorkers Dsj Cpa

Long Term Capital Gains Tax Rates In 2021 Darrow Wealth Management

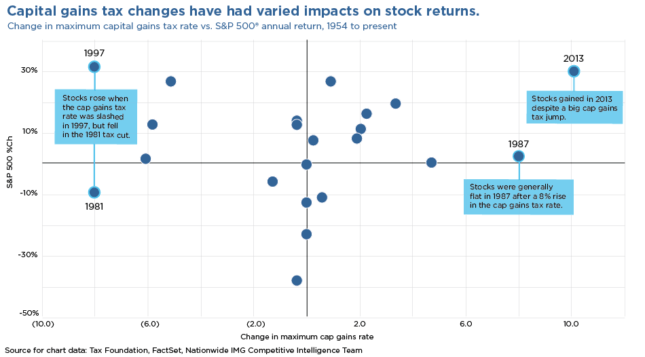

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Capital Gains Tax In The United States Wikipedia

For Founders The Implications Of Joe Biden S Proposed Tax Code

Tax Foundation On Twitter Raising The Top Capital Gains Tax Rate To 39 6 Percent For Those Earning Over 1 Million Would Reduce Federal Revenue By About 124 Billion Over 10 Years According

Tax Foundation On Twitter President Elect Joe Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top

Concerns Rise Over Tax Increase Proposals Nationwide Financial

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

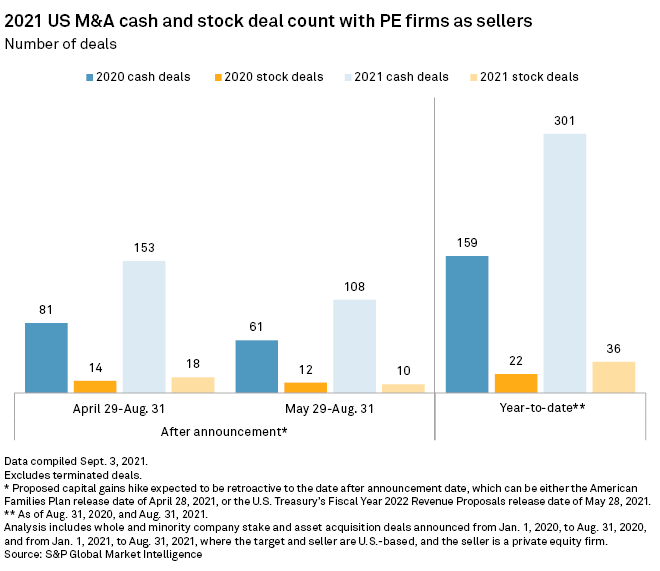

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Biden S Election Doesn T Mean You Have To Sell In 2020 Rosebiz Inc

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century